Return to Office (RTO) mandates are coming. For example "Amazon calls workers back 5 days a week—other companies may be ‘right behind them,’ expert says." RTO is poised to dramatically reshape the real estate market, especially in regions that experienced significant change due to the remote work trend during the pandemic. During the COVID-19 crisis, many employees transitioned to working from home, prompting a surge in demand for suburban and rural properties as people sought larger living spaces and affordable housing farther from city centers. However, with companies now mandating a return to in-person work, we are likely to see several critical trends unfold:

1. Renewed Demand for Urban Housing

As companies enforce Return to Office (RTO) mandates, the demand for homes and rental properties in urban areas is expected to surge. During the pandemic, many workers took advantage of remote work by relocating to suburban or even rural areas in search of more space and lower costs. However, with the shift back to in-person work, urban centers that previously saw population dips may experience a significant rebound. Cities like Arlington, Alexandria, and Crystal City—which are well-known for their proximity to major employment hubs and government offices—are expected to become more competitive markets once again.

Employees returning to work will prioritize convenience in their housing choices, placing a higher value on proximity to their workplaces to minimize commute times. As a result, homes and rental units near central business districts, tech hubs, and government offices will see increased interest. Moreover, access to efficient public transportation such as METRO stations or key highway routes will play a major role in driving demand. Urban areas offering walkability, public transit options, and proximity to office spaces will attract more buyers and renters, as workers seek to balance the demands of daily or hybrid commuting schedules. This trend is likely to push up housing prices and rental rates in urban neighborhoods, further intensifying competition for desirable properties.

Additionally, the lifestyle amenities associated with city living—such as dining, entertainment, and cultural attractions—will also draw workers back to urban environments, making these areas increasingly appealing for young professionals and families alike. The renewed focus on urban housing highlights a potential shift in the market, with cities once again becoming the center of economic activity and housing demand.

2. Shift in Suburban and Rural Housing Markets

During the pandemic-driven remote work boom, suburban and rural areas experienced a surge in demand as people sought larger homes, privacy, and more affordable living compared to urban areas. The appeal of having more space for home offices, outdoor areas, and a quieter lifestyle led many workers to relocate away from cities. This trend significantly boosted housing prices in these regions, especially in far-flung suburbs and rural areas, where homes were more affordable and spacious compared to city dwellings.

However, with the rise of Return to Office (RTO) mandates, this demand is expected to taper off. Workers who moved to distant suburban or rural areas now face the prospect of long commutes, which may not be sustainable or desirable for those required to be in the office full-time. As a result, farther-out suburbs, which thrived during the remote work era, may experience a cooling in price growth as demand levels off. Homebuyers and renters are likely to reconsider the trade-offs of long commutes, which could slow down both price increases and sales activity in these more remote areas.

On the other hand, commutable suburbs—those within a reasonable driving distance or with easy access to public transit options—could retain their appeal, particularly as many companies adopt hybrid work models. These areas, located closer to urban centers, offer a balance between suburban space and access to city jobs, making them attractive for workers who only need to commute a few days a week. Suburbs like Fairfax, McLean, and North Arlington—which offer proximity to major metropolitan areas like Washington, D.C., along with high-quality schools and family-friendly amenities—are likely to remain in demand.

In addition, hybrid work arrangements allow workers to enjoy the benefits of living in suburban or semi-rural settings while still maintaining a connection to their urban workplaces. These flexible work models may lead to continued interest in larger homes with more outdoor space, but the emphasis will be on maintaining reasonable commuting distances. As a result, suburban markets close to transportation hubs and major highways will likely remain competitive, while more remote areas may face a slowdown as commuting considerations return to the forefront of housing decisions.

Overall, the shift in the suburban and rural housing markets will reflect the evolving needs of workers, with commutability and work-life balance playing a larger role in determining where people choose to live.

3. Hybrid Work and Housing Flexibility

As many companies adopt hybrid work models, which allow employees to split their time between working from home and being present in the office, housing preferences are evolving to reflect this new balance. Rather than requiring a full-time return to urban living, hybrid work offers workers the flexibility to remain in suburban areas while still maintaining access to their workplaces for the days they need to commute. This shift in work culture is reshaping how people approach their housing decisions, offering a middle ground between urban and suburban lifestyles.

For many, the appeal of suburban living remains strong, particularly for families and individuals seeking more space and a quieter environment. However, hybrid work models require homes to be located within commutable distances to major urban centers, allowing workers to easily reach the office on their designated in-person days. This trend is likely to favor neighborhoods in Ballston, Del Ray, and Fairfax, which offer the best of both worlds—suburban space combined with proximity to the city, public transportation, and key amenities. These areas provide convenient access to Washington, D.C., and other employment hubs, making them attractive for those balancing both work-from-home and office days.

Housing flexibility is now a critical factor in the decision-making process, as many workers are seeking homes that can support multi-functional spaces. Dedicated home offices, previously considered a luxury, have become a necessity for workers who spend a portion of their time remote. Many buyers and renters are looking for properties with enough room to set up a productive workspace, whether through extra bedrooms, finished basements, or larger living areas. In addition, properties with outdoor space, such as patios, decks, or gardens, continue to be in demand, as these areas provide relaxation and work-from-home alternatives during nice weather.

Furthermore, hybrid work models allow workers to maintain a better work-life balance, and housing that supports this flexibility is becoming more attractive. Workers who no longer need to be in the office five days a week can prioritize quality of life in suburban settings, choosing homes that offer more space, access to nature, and proximity to good schools and community resources. Meanwhile, on their in-office days, they can easily commute to work, striking the right balance between the two.

As companies continue to refine their hybrid work policies, the housing market will likely continue to evolve. Suburban and urban-adjacent neighborhoods that provide both convenience and comfort will remain in high demand, especially as people seek homes that meet their changing lifestyle needs. This flexibility is giving buyers and renters more options, allowing them to stay close to work while enjoying the benefits of suburban living. As a result, housing markets in regions like North Arlington, Fairfax, and Del Ray will continue to thrive as hybrid work becomes a lasting element of the post-pandemic work environment.

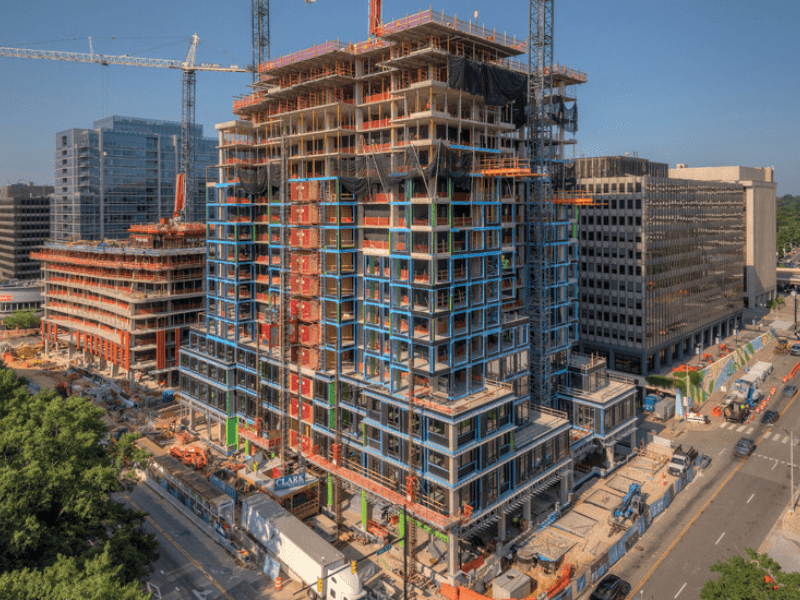

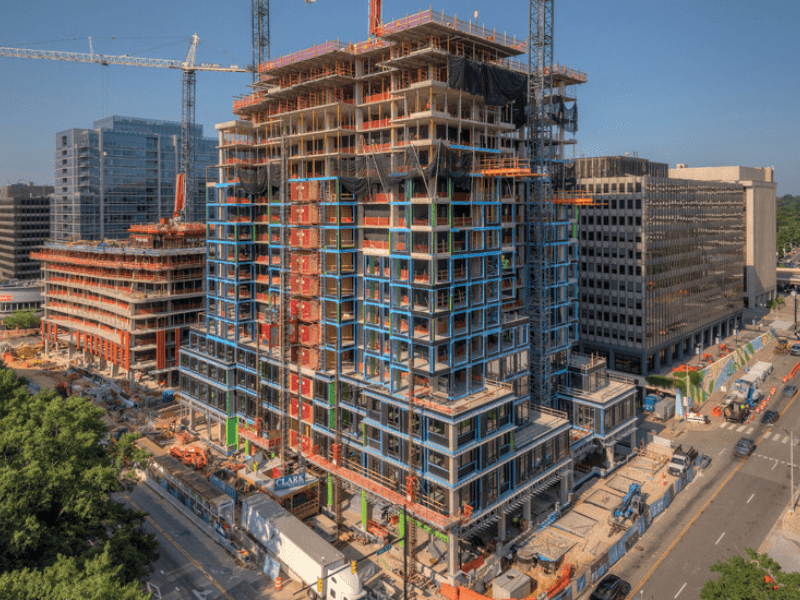

4. Revitalization of Commercial Real Estate

As companies implement Return to Office (RTO) mandates and more employees return to in-person work, the commercial real estate market, particularly in urban centers, is expected to see a significant boost. During the pandemic, many businesses transitioned to remote work, leaving office spaces underutilized or even vacant for extended periods. This led to a slump in demand for traditional office leases, especially in high-density urban areas. However, with the gradual return to office settings, cities like Arlington and Clarendon, known for their significant commercial office space, could experience a revitalization of their business districts.

Companies that had downsized their office footprints or moved to fully remote models during the pandemic may now be seeking to re-establish their physical presence, driving renewed demand for office properties. Buildings that once sat empty or experienced lower leasing activity could now see a surge of interest from businesses looking to accommodate their returning workforce. This is especially true for areas like Crystal City and Ballston, which are close to major employers and offer excellent public transit options, making them attractive locations for businesses that need to bring employees back into a centralized work environment.

However, the nature of office spaces is evolving, and this transformation is likely to shape the future of the commercial real estate market. With many companies adopting hybrid work models, which combine remote work with in-office days, the demand for traditional large-scale office spaces may decrease. Instead, businesses are likely to look for more flexible workspaces that can accommodate fluctuating employee presence. This has led to a growing interest in co-working environments and shared office spaces, where businesses can lease smaller areas that better align with their new operational needs.

The rise of flexible office arrangements has opened the door for companies to explore innovative office designs, such as open-plan layouts, hot desking, and collaboration areas that facilitate both remote and in-person work. The need for adaptable spaces is driving commercial real estate developers and property managers to rethink how they structure office buildings, offering more modular and customizable workspaces to cater to the demands of hybrid workforces.

In addition to flexible workspaces, the commercial real estate market is seeing a shift toward creating more experience-driven office environments. Businesses are investing in high-quality amenities and communal spaces to attract employees back to the office. This includes features like wellness centers, rooftop terraces, on-site cafes, and enhanced technology infrastructure that supports both remote and in-office work. For example, office buildings in Clarendon and Arlington may incorporate such amenities to draw in businesses looking to provide employees with a more engaging, collaborative workspace that justifies their commute and in-office presence.

In summary, while the commercial real estate market in urban centers is poised for revitalization as companies bring employees back, the landscape is changing. Traditional office leases may give way to flexible, adaptable workspaces that cater to the hybrid work model. Developers and landlords who can offer innovative, high-tech, and experience-driven office environments will be best positioned to capitalize on the new wave of commercial real estate demand. As companies redefine what their office spaces look like in a post-pandemic world, cities like Arlington, Clarendon, and Crystal City are likely to see a resurgence in activity, breathing new life into their business districts.

5. Fluctuations in Housing Prices

The real estate market is likely to experience notable fluctuations in housing prices as the effects of Return to Office (RTO) mandates reshape buyer preferences and demand. With more employees returning to in-person work, particularly in urban centers, housing prices in city areas are expected to rise once again. Cities like Arlington, Alexandria, and Crystal City, which are home to many office buildings and commercial hubs, could see a surge in demand for homes and rental properties as workers seek to shorten their commutes. This renewed interest in urban living will likely lead to increased competition for available properties, pushing up prices in these desirable, centrally-located areas.

At the same time, areas that experienced a housing boom during the pandemic’s remote work trend—such as suburban and rural regions far from city centers—may experience a slowdown in price growth or even price corrections. As workers were able to work remotely, many chose to relocate to areas that offered more space, privacy, and lower costs compared to urban living. However, as RTO mandates take effect and the need to commute becomes a reality once again, the demand for homes in distant suburbs or rural locations may decline. Workers facing long, daily commutes to their offices may reconsider the trade-offs of living far from urban job centers, which could reduce the desirability of these areas and result in more stagnant housing prices or even declines in certain regions.

On the other hand, commutable suburbs—those located within a manageable distance to city centers and with access to public transportation—are likely to maintain their appeal, particularly for workers in hybrid work models. Hybrid workers, who only need to be in the office part-time, may continue to value the space and affordability of suburban homes while also requiring convenient access to their workplaces. These suburban markets, such as Fairfax, McLean, or North Arlington, are likely to remain competitive, as they offer the best of both worlds: spacious homes for remote work and easy access to urban areas for in-office days.

Additionally, as more businesses adopt hybrid work models, the demand for homes with dedicated office spaces, larger living areas, and outdoor amenities will continue to influence the housing market. Buyers may still prefer suburban areas that offer the flexibility to comfortably work from home, while also considering the need for a shorter commute on office days. This dynamic could keep housing prices in well-connected suburbs steady or even increase them as hybrid work becomes a long-term reality.

Ultimately, these shifts in demand will result in price volatility across different regions. Urban areas will likely experience a price resurgence, while far-flung suburbs may see prices stabilize or decline. Commutable suburbs will retain strong demand, making them a focal point for those seeking balance between work and lifestyle needs. Buyers, sellers, and investors will need to carefully monitor these trends to navigate the real estate market successfully as the effects of RTO mandates continue to play out.

6. Increased Importance of Transit-Oriented Development

As Return to Office (RTO) mandates bring workers back to in-person roles, the importance of transit-oriented development (TOD) is expected to rise significantly. Proximity to public transportation is becoming a top priority for homebuyers and renters, especially in urban and suburban areas where long commutes were previously less of a concern during the remote work era. With commuting becoming a regular part of the workweek once again, homes and neighborhoods near major transit hubs such as METRO stations or key highway access points will see a surge in demand.

Transit-oriented developments are designed to promote walkability, easy access to public transportation, and reduced reliance on cars for commuting. These communities often feature mixed-use developments that combine residential, retail, and commercial spaces within close proximity to transit infrastructure. With more employees now required to commute regularly, homes near public transportation networks like the D.C. Metro system will be highly sought after, as workers prioritize shorter, more efficient commutes over the need for additional space.

Areas like Ballston and North Arlington, which are known for their excellent accessibility to the D.C. Metro system, are poised to see increased interest from buyers and renters. These neighborhoods offer a perfect blend of urban convenience and suburban comfort, making them ideal for workers who need to commute into Washington, D.C. but still desire a more residential setting. For many, the ability to live within walking distance or a short drive to a Metro station will become a major selling point, as it significantly reduces commuting stress and time.

Moreover, transit-oriented developments are often designed with additional amenities that appeal to modern lifestyles, such as retail spaces, restaurants, and green spaces within the community. This integration of housing and amenities creates a more convenient and vibrant environment for residents, who can easily access everyday needs without long drives or relying on cars. As workers return to a hybrid or full-time office schedule, the convenience of these TOD areas will become even more attractive.

For homebuyers and investors, properties located near transit hubs and highways are likely to experience appreciation in value as demand increases. Shorter commutes are often associated with a higher quality of life, and transit-friendly locations are likely to remain competitive, even as more workers embrace hybrid work models. These developments also appeal to a wide range of demographics, from young professionals who need to commute regularly to families looking for a balance of suburban amenities and easy access to urban job centers.

In addition, cities and regions may see an increased push for the development of new transit infrastructure and expansion of existing public transportation networks. With growing recognition of the importance of public transit in fostering sustainable urban growth, local governments may prioritize investments in new rail lines, bus systems, or light rail networks to further support transit-oriented living. This trend is likely to encourage more developers to focus on creating walkable, transit-centric communities, where residents can benefit from reduced traffic congestion and easy commuting options.

In conclusion, as workers return to in-office roles, the importance of transit-oriented development will continue to grow. Neighborhoods near public transportation hubs and major highways will see increased demand as workers prioritize convenience and commute efficiency. Areas like Ballston and North Arlington, with their accessibility to the D.C. Metro system, are likely to thrive in this new real estate landscape, where being close to transit is a major selling point. Transit-oriented development is set to play a crucial role in shaping the future of housing demand in urban and suburban areas.

7. Impact on Investment Strategies

As Return to Office (RTO) mandates reshape the real estate landscape, investors in both residential and commercial sectors will need to rethink their strategies to align with shifting market dynamics. The pandemic-driven demand for suburban and rural properties, spurred by the rise of remote work, is now giving way to renewed interest in urban areas, and investors will need to navigate these changes carefully to capitalize on emerging opportunities.

In the residential rental market, multi-family housing in urban centers is expected to see a resurgence as renters migrate back to cities in response to RTO mandates. During the remote work boom, many urban dwellers left cities for suburban and rural areas, leading to a temporary cooling in demand for urban rentals. However, with more employees required to return to in-person work, the demand for rentals in city centers like Arlington, Alexandria, and Ballston will likely increase, driving up both occupancy rates and rental prices. Investors with holdings in multi-family properties or those looking to enter the rental market may find lucrative opportunities in urban areas, where convenience and proximity to workplaces are key factors for renters returning to the city.

In the commercial real estate sector, the evolving nature of office work is creating new challenges and opportunities for investors. While traditional office space leasing is expected to see a revival as businesses bring employees back to physical offices, the rise of hybrid work models is also changing the types of spaces companies are looking for. Businesses are seeking more flexible, adaptable office environments that can accommodate both in-office and remote work. This shift presents an opportunity for investors to redevelop or repurpose office properties to meet these changing needs. For example, investing in co-working spaces, shared offices, or flexible workspaces could be a smart move, as these types of setups are increasingly in demand by businesses looking for cost-effective, flexible options.

Additionally, there is potential for investors to capitalize on the growing trend of mixed-use developments, which combine residential, office, and retail spaces into a single property. These developments cater to the post-pandemic lifestyle by offering convenience, walkability, and easy access to both workspaces and amenities. Commercial real estate investors who can create or invest in these kinds of properties in transit-oriented or high-demand urban areas will likely see strong returns as cities continue to bounce back.

In contrast, suburban and rural markets, which experienced a surge in demand during the remote work era, may now require a more cautious approach from investors. While these areas boomed as workers sought out larger homes and more space, the rise of RTO mandates could cause demand to fluctuate or even decline in certain far-flung suburban and rural regions. Investors who heavily invested in these markets may face slower growth or price corrections as workers relocate closer to urban centers for easier commuting. As a result, those investing in suburban properties should carefully consider whether the location offers a manageable commute for hybrid workers and access to key amenities like schools, shopping, and public transit.

However, commutable suburban areas—those within a reasonable driving or public transit distance from major cities—may continue to perform well, especially if hybrid work remains a long-term trend. Suburban areas like McLean, Fairfax, and Del Ray are positioned to remain attractive for families and workers who want the benefits of suburban living without sacrificing easy access to city offices.

Moreover, the shift in commercial real estate demand may affect retail spaces as well. With more workers returning to city centers, urban retail spaces may see a boost in foot traffic, offering new opportunities for investors in retail properties located near offices or within mixed-use developments. On the other hand, suburban retail centers that thrived during the remote work era may see demand soften as workers spend less time in suburban areas during the workweek.

In summary, the impact of RTO mandates on investment strategies is significant. Investors in multi-family housing and commercial office spaces in urban areas should prepare for rising demand, while those in suburban and rural markets must take a more measured approach. The key for investors will be to stay flexible, focusing on adaptable, hybrid-friendly workspaces and transit-accessible locations that meet the evolving needs of both businesses and workers. Diversifying portfolios to include mixed-use properties and keeping a close eye on market trends will be crucial for navigating this new real estate landscape.

Conclusion

The Return to Office mandates will undoubtedly bring significant changes to the real estate market. Urban areas will likely experience a resurgence in demand for housing, while some suburban and rural markets could see a slowdown. However, the rise of hybrid work will provide flexibility for workers, keeping many suburban areas attractive, particularly those with good access to city centers. The real estate market will continue to evolve as both workers and employers adjust to the new normal of balancing in-office and remote work.

Looking to buy, sell, or manage property in Northern Virginia? Arlington Abodes Realty & Property Management is here to help! Led by top Realtor Brad Winkelmann, we offer expert real estate services and full-service property management with a commitment to excellence. Whether you're in Arlington, Alexandria, Falls Church, Ballston, or the surrounding areas, our team brings over 20 years of experience and a deep understanding of the local market.

We specialize in serving diverse clients, including those in the Military, Government, Technology, and other sectors, with personalized, professional care. Let us help you navigate Northern Virginia's real estate market with proven results and unmatched service.

For more information about Property Management and Real Estate Services, please feel free to contact us at Arlington Abodes Realty & Property Management. Also, follow me on Facebook for tips and news. Also consider our other resources such as: "Will Arlington County Property Owners Pay More Taxes in 2025," "Missing Middle Arlington: Key Zoning Laws Every Property Owner Should Know," and "Arlington Virginia Home Affordability: Understanding the 2024 Housing Market Trends."